Related Resources:

Campus Divestment Campaigns: JLens Unpacks the Demands and Consequences

The Economic Risks of Divestment from Israel for University Endowments

The Legal Risks of Divestment from Israel for University Endowments

The Impact of Divestment Campaigns on Rising Antisemitism

The Impact of Israel Divestment on Equity Portfolios: Forecasting BDS’s Financial Toll on University Endowments (JLens Report)

JLens – the Impact of Israel Divestment on Equity Portfolios – Fall 2024

Abstract

This JLens report ("The Impact of Israel Divestment on Equity Portfolios: Forecasting BDS's Financial Toll on University Endowments") examines the potential financial impact of Boycott, Divestment and Sanctions (BDS) aligned investment strategies on the 100 largest university endowments. Using historical performance data from 2014-2024, JLens compared a broadly diversified equity index (VettaFi 500) to an index excluding 38 companies specifically targeted by BDS campaigns (VettaFi Excl. BDS Top Targets). The analysis revealed that the BDS-aligned index consistently underperformed, with an annualized return 1.8% lower over 10 years (11.1% vs 12.9%).

Projecting these findings to the 100 largest university endowments from 2023 to 2033, JLens forecasts an aggregate loss of $33.2 billion if these institutions were to adopt BDS-aligned investment strategies for their public equity asset allocations. These projections, based on historical performance data and current endowment allocations, underscore the potentially significant financial consequences of BDS-aligned investment decisions for higher education institutions. The report acknowledges limitations in its methodology and assumptions, but aims to provide a data-driven starting point for discussions on the economic implications of divestment strategies.

See Database of Projected Impact of Israel Divestment on 100 Top University Endowments

Executive Summary

The Boycott, Divestment and Sanctions movement (BDS) is an international campaign, which began in the mid-2000s, aimed at delegitimizing and pressuring Israel, through the diplomatic, financial, professional, academic and cultural isolation of Israel, Israeli individuals, Israeli institutions, and, increasingly, Jews and others who support Israel’s right to exist. Divestment campaigns, such as those being called for today, aim to delegitimize and pressure Israel through, among other methods, the financial isolation of Israel.[i]

In the wake of Hamas's October 7, 2023 attack on Israel, college campuses across the United States became epicenters of anti-Israel protests. From Columbia[ii] to UCLA,[iii] students advocated for policies aligned with the BDS movement and established encampments, occupied buildings and disrupted academic activities. Some campus protestors were even seen lauding Hamas and advocating for violence.[iv] These protests created an atmosphere of tension, particularly for Jewish students and supporters of Israel. As universities begin the fall semester, there is a high likelihood that these demonstrations will resume, with a renewed focus on pressuring institutions to divest from companies with business interests in Israel.

The targets of these divestment campaigns encompass a wide spectrum of companies with varying degrees of involvement in Israel. These range from multinational corporations with significant research and development facilities[v] or manufacturing plants in Israel,[vi] to companies in the tourism industry.[vii] The list also includes firms providing goods and services to Israeli government agencies or military,[viii] financial institutions operating in the country,[ix] and companies with infrastructure projects in Israel.[x] Even businesses with seemingly minor connections,[xi] such as international fast-food chains with franchise agreements in Israel or companies simply maintaining offices there, have not been spared from these divestment calls. This broad targeting strategy effectively implicates a substantial portion of the global business community, potentially affecting diverse sectors of university endowment portfolios.

Several BDS organizations and activists (“BDS Proponents”) have published lists of companies they deem “complicit in Israel's actions,” calling for boycotts and divestment. These lists include major U.S. public companies, potentially impacting significant portions of university endowment portfolios.

To date, the discourse surrounding divestment has primarily centered on moral arguments for and against doing so and the potential economic consequences have received less attention. This report aims to address this gap by forecasting the financial impact of Israel divestment on university endowments’ equity portfolios.

The research design is simple and direct. JLens compared the historical performance of two hypothetical portfolios: 1) a broadly diversified portfolio without constraints, and 2) a broadly diversified portfolio that excludes BDS-targeted companies. The methodology seeks to evaluate the investment consequences of divesting from companies targeted by BDS campaigns. The process begins with identifying BDS-targeted companies and creating a modified index, then progresses through a detailed comparison of index performances and culminates in a forecast of potential losses for major university endowments. By following these steps, JLens quantified the financial implications of BDS-aligned investment decisions for higher education institutions. JLens acknowledges there are limitations to the simple research design and the core assumption that the historical performance period analyzed is a rough approximation for what one might expect in the future.

The following list outlines each step of this thorough analytical approach:

Step 1: Creation of "BDS Top Targets List”

- JLens reviewed lists of companies targeted by six BDS-aligned organizations ("BDS Proponents").

- JLens compiled a list[xii] of 38 BDS-targeted companies among the 500 largest U.S. public companies.

Step 2: Selection of benchmark index

- JLens selected the VettaFi US Equity Large-Cap 500 Index[xiii] as the benchmark.

Step 3: Application of the negative screen

- JLens applied the "BDS Top Targets List" as a negative screen to create the VettaFi Excl. BDS Top Targets index.

Step 4: Backtest analysis and performance comparison

- JLens conducted a performance summary backtest of both indices over a ten-year period (2014-2024), as well as for five-year, three-year and one-year intervals.

- JLens analyzed and compared the performance of both indices.

Step 5: Data collection for university endowments

- JLens gathered data on the 100 largest university endowments as of 2023 ($665 billion total AUM).

Step 6: Determination of forecast period

- JLens set a 10-year forecast period from 2023 to 2033.

Step 7: Estimation of public equity allocation

- JLens estimated the portion of university endowments allocated to U.S. large-cap public equities.

Step 8: Application of performance differences

- JLens applied the performance difference between the two indices to the estimated public equity allocations.

Step 9: Calculation of potential underperformance

- JLens calculated the potential underperformance for each university endowment over the 10-year period.

Step 10: Aggregation and analysis of results

- JLens summed up the potential losses across all 100 university endowments and analyzed the overall impact.

The core result suggests that BDS-aligned divestment will likely hurt long-term performance. The VettaFi Excl. BDS Top Targets index consistently underperformed compared to the VettaFi 500 index, lagging on an annualized basis by 1.8% over a ten-year period (11.1% vs 12.9%), 2.4% over a 5-year period (12.7% vs. 15.1%), 2.9% over a 3-year period (6.2% vs 9.1%) and 9.5% over a one-year period (15.4% vs 24.9%).

The analysis revealed significant financial implications for university endowments adopting BDS-aligned investment strategies. The performance gap between the indices translates to substantial deviations in portfolio performance over a long period of time. In other words, there are foregone gains when compounded over time. For instance, a $1 billion hypothetical equity allocation invested in the VettaFi 500 index would grow to $3.365 billion over ten years, while the same endowment following the BDS-aligned strategy would only reach $2.865 billion, missing out on nearly $500 million in returns. Similarly, a $3 billion allocation would miss out on nearly $1.5 billion in returns while a $5 billion allocation would miss out on nearly $2.5 billion of returns.

Projecting these findings to the 100 largest university endowments from 2023 to 2033, JLens forecasts an aggregate loss of $33.2 billion if these institutions were to adopt BDS-aligned investment strategies for their public equity asset allocations. The five largest endowments could each face average losses ranging from $1.7 billion to nearly $2.5 billion in future market value. These projections, based on historical performance data and current endowment allocations, underscore the potentially significant financial consequences of BDS-aligned investment decisions for higher education institutions.

Methodology & Findings

Step 1: Creation of “BDS Top Targets List”

JLens conducted a comprehensive review of companies targeted by the Boycott, Divestment and Sanctions (BDS) movement. This process involved analyzing research from six prominent pro-BDS organizations, collectively referred to as "BDS Proponents": American Friends Service Committee, Boycott-Israel.org, the Palestinian BDS National Committee, the Office of the United Nations High Commissioner for Human Rights (OHCHR), Who Profits and Don't Buy Into Occupation Coalition. Detailed information on each BDS Proponent can be found in Appendix 1.

JLens notes that there are many other organizations that support BDS, but do not publish divestment targets, such as the National Students for Justice in Palestine. Additionally, on the local level, activists have compiled their own divestment lists. For example, Brown University's Students for Justice in Palestine created a list of ten companies targeted for divestment, while Oberlin College activists reportedly identified 130 companies.[xiv] However, JLens chose to focus on prominent pro-BDS organizations that have published online lists of divestment targets, presumably aiming to encourage widespread adoption of their campaigns.

A key finding of this review was the lack of unified methodology or central coordination among BDS Proponents. This inconsistency led to significant variations in their targeting criteria and calls to action. Some organizations focused on companies allegedly involved in the post-October 7 war in Gaza, while others identified companies based on alleged activities such as operations in the West Bank or Gaza, sales of goods or provision of services to the Israeli government and military, or broader business operations within Israel. Similarly, the BDS Proponents' advocacy ranged from merely providing information on a company's alleged involvement in Israel to directly calling for divestment and/or boycotts of specific companies.

Further complicating the issue, BDS Proponents often failed to provide clear rationales for removing companies from their lists. In some cases, companies that had partially or fully exited their Israeli operations remained targeted. For example, Microsoft sold its stake in AnyVision, an Israeli facial recognition software company[xv] in 2020, yet still appears on some BDS Proponents' lists of targeted companies. This lack of consistency and transparency in the BDS Proponents’ methodologies underscores the complexity of the issue and the need for careful, independent analysis when considering the implications of their recommendations.

Additionally, the landscape of companies doing business in Israel is vast and ever-changing, making it challenging to compile a definitive list of BDS targets that does not become quickly outdated. Many large U.S. public companies have significant ties to Israel and the list of potential BDS targets can expand at any time due to evolving geopolitical events and misguided activist campaigns. This dynamic nature of BDS targeting was exemplified during the editing phase of this research report, when BDS proponents expanded their calls for boycotts and divestments to include major corporations like Coca-Cola,[xvi] which is also a constituent of the VettaFi 500 index. This recent addition underscores the fluid nature of BDS campaigns and the potential for rapid shifts in targeted companies.

It's important to note that newly targeted companies were not included in the BDS Top Targets List compiled by JLens. This exclusion reflects the temporal nature of the research, as the list represents those companies targeted during the specific time period when JLens conducted its research and quantitative analysis. This limitation highlights the need for ongoing monitoring and regular updates to any BDS-related company lists, as the landscape can change rapidly in response to geopolitical events, corporate actions and evolving activist strategies.

Acknowledging this dynamic environment, JLens developed a focused and conservative "BDS Top Targets List". This list includes companies that are:

1) targeted by at least one BDS Proponent during the research and quantitative analysis phases of this report, typically within a BDS Proponent’s online database or list of companies with alleged activities and

2) constituents of the VettaFi 500 index, which is an index comprised of the largest U.S. public companies.

Many companies were present on multiple BDS Proponents’ lists. Additionally, JLens used publicly available information on Israel-related boycott campaigns to supplement information published by the BDS Proponents. By using the BDS Proponents as a source, JLens was conservative in the number of BDS-target companies that was included in the analysis. More specifically, JLens conducted its own research into companies that have significant activities in Israel, such as companies that have offices in Israel or partnerships with Israeli companies, and identified 198 companies in the VettaFi 500 index, comprising 69% of the total market capitalization of the VettaFi 500 index. In comparison, the BDS Top Targets List contained 38 targeted companies, which comprised 32.3% of the market capitalization of the VettaFi 500 index, as of June 30, 2024.

The companies in the BDS Top Targets List receive the most attention from BDS Proponents and are thus at a higher risk for divestment. However, the BDS Top Targets List is not an exhaustive list of companies that may be targeted by BDS Proponents, particularly given the dynamic nature of current events and activist campaigns as well as the large number of large public U.S. companies with significant activities in Israel.

BDS Top Targets List

ADL Backgrounder on BDS[xviii]

The Boycott, Divestment and Sanctions movement (BDS) is an international campaign, which began in the mid-2000s, aimed at delegitimizing and pressuring Israel, through the diplomatic, financial, professional, academic and cultural isolation of Israel, Israeli individuals, Israeli institutions and, increasingly, Jews and others who support Israel’s right to exist.

Divestment campaigns, such as those being called for today, aim to delegitimize and pressure Israel through, among other methods, the financial isolation of Israel.

On campus, while the specific calls to action might differ, most divestment campaigns are focused on university endowments and their investments. Some also call for divesting from Israeli companies directly, or lists of American or multinational companies they allege are enabling Israeli actions in the West Bank and Gaza. Some don’t even reference Israel, and ostensibly focus on broader human rights issues, but are implicitly directed at Israel.

Some campus supporters of BDS action may be unaware of the broader goals and implications of the BDS movement and instead believe it is a vehicle to promote a resolution of the Israeli-Palestinian conflict and to support Palestinian rights. Nothing can be farther from the truth, as BDS campaigns are fundamentally biased and unconstructive. BDS rejects the pursuit of dialogue and understanding and instead actively works to dehumanize Israelis, Zionists and those who feel connected to Israel. BDS opposes the fundamental building blocks for Israeli-Palestinian understanding, peace-building and ultimate reconciliation, even at the grassroots level.

ADL believes that many of the founding goals of the BDS movement, which effectively reject or ignore the Jewish people’s right of self-determination, or that, if implemented, would result in the eradication of the world’s only Jewish state, are antisemitic. Additionally, BDS campaigns on campus frequently contribute to divisiveness and hostility and many have featured antisemitic rhetoric and incidents, directly impacting Jews and those who feel a connection to Israel.

Step 2: Selection of Benchmark Index

JLens conducted its analysis using the VettaFi US Equity Large-Cap 500 Index (“VettaFi 500 index”). The VettaFi 500 index represents the 500 largest U.S. stocks by market capitalization. VettaFi provides an index methodology and fact sheet on the VettaFi 500 index. The VettaFi 500 index has historically shown high correlation in returns with the S&P 500,[xix] and both the VettaFi 500 and S&P 500 represent the largest U.S. stocks. However, it's important to note some key differences:

- The VettaFi 500 index is fully passive and strictly rules-based, including the top 500 companies by market capitalization without any profitability requirement.

- In contrast, the S&P 500 is managed by a committee, allowing some discretion in stock selection and requires companies to have four consecutive quarters of positive earnings.

These methodological differences can lead to slight variations in composition and performance between the two indexes. Nevertheless, the VettaFi US Equity Large-Cap 500 Index provides a robust and representative basis for comparing the potential financial impacts of BDS-aligned investment strategies.

Step 3: Application of the Negative Screen

JLens used the VettaFi 500 index as the starting universe to form the VettaFi Excl. BDS Top Targets index. JLens applied the BDS Top Targets List as a negative screen[xx] to the VettaFi 500 index to create the VettaFi Excl. BDS Top Targets index, meaning that the 38 companies in the BDS Top Targets List were excluded in the VettaFi Excl. BDS Top Targets index and no other adjustments were made to the index. The VettaFi 500 index served as both the starting universe and a benchmark to the VettaFi Excl. BDS Top Targets index.

Step 4: Backtest Analysis and Performance Comparison

Backtest

JLens conducted a backtest of the VettaFi Excl. BDS Top Targets index and the VettaFi 500 index from the period of July 1, 2014 to June 30, 2024.[xxi] The backtest involved calculating daily returns based on market performance over the ten-year period. For each index, JLens received the index’s daily return for each day over the ten-year period.

JLens analyzed performance summary data to determine the performance differences between the indices. JLens analyzed metrics such as number of equity holdings, annual performance, top ten holdings and sector allocations.

Performance Analysis

The VettaFi Excl. BDS Top Targets index consistently underperformed on an annualized basis compared to the VettaFi 500 index, measured over the period of July 1, 2014 to June 30, 2024 (see Exhibit One).

Exhibit One:

Over this ten-year period, the VettaFi Excl. BDS Top Targets index lagged behind the VettaFi 500 index by 180 basis points on an annualized basis, translating into $500 million of underperformance on a portfolio with a $1 billion initial value (see Exhibit Two).

Exhibit Two:

Additionally, in nine out of the ten years, the VettaFi Excl. BDS Top Targets index had a lower annual performance compared to the VettaFi 500 index (see Exhibit Three). The largest difference occurred in 2023, in which there was a 7.94% gap in annual performance.

Exhibit Three:

Annual Performance of VettaFi Excl. BDS Top Targets index, compared to the VettaFi 500 index (2015-2024):

Despite comprising less than 10% of the number of companies in the VettaFi 500 index, the BDS Top Targets List represents a substantial proportion of the total market capitalization of the broader index: The cumulative market capitalization of the 38 companies excluded amounts to 32.3% of the total market capitalization in the VettaFi 500 index, as of June 30, 2024 (see Exhibit Four). This high concentration of market capitalization underscores the impact of these exclusions on the performance differences between the VettaFi Excl. BDS Top Targets index and the VettaFi 500 index.

Exhibit Four:

Index Composition

The top ten holdings of the VettaFi Excl. BDS Top Targets index are substantially different from the top ten holdings of the VettaFi 500 index. Six companies in VettaFi 500 index’s top ten holdings – Microsoft, Nvidia, Amazon, Meta, Alphabet and JPMorgan – are excluded in the VettaFi Excl. BDS Top Targets index. The four companies that remain – Apple, Eli Lilly, Berkshire Hathaway and Broadcom – hold more weight in the VettaFi Excl. BDS Top Targets index compared to the VettaFi 500 index (see Exhibit Five).

Exhibit Five

For analysis on the sector allocations of the VettaFi Excl. BDS Top Targets index and the VettaFi 500 index, see Appendix 2.1.

Impact of Divestment on Theoretical Endowments

This substantially poorer performance compounds into significant loss of value over time. By way of background, due to the compounding effect, which refers to the process where the value of an investment grows exponentially over time as the earnings on an investment generate their own earnings, even small differences in annual returns can lead to significant differences in future value, especially over longer periods.

When considering the growth of equity portfolios with different initial investments over 10 years, the impact of varying annual returns becomes evident. For example, an endowment with $1 billion in assets under management invested in VettaFi Excl. BDS Top Targets index would grow annually by 11.1% to $2.865 billion over a period of ten years, while the same $1 billion endowment invested in the VettaFi 500 index would grow by 12.9% to $3.365 billion. An endowment invested in VettaFi Excl. BDS Top Targets index would have missed out on $500 million in returns compared to the VettaFi 500 index (see Exhibit Six and Exhibit Seven).

Exhibit Six

Initial investments of $1 billion, $3 billion, $5 billion with annual returns of 12.9% in the VettaFi 500 index or 11.1% in the VettaFi Excl. BDS Top Targets index, would have the following growth over a period of ten years:

Exhibit Seven

Step 5: Data Collection for University Endowments

To understand the real world impact of a BDS-aligned investment strategy, JLens gathered data on the 100 largest university endowments as of 2023, which have a combined $665 billion of assets under management (AUM) according to publicly available data from the National Association of College and University Business Officers (NACUBO).[xxii] NACUBO received endowment values directly from institutions that volunteered to participate in the 2023 NACUBO-Commonfund Study of Endowments. See Appendix 2.2 for a list of the 100 largest university endowments by market value.

Step 6: Determination of Forecast Period

JLens aimed to provide a forward-looking assessment of the impact of a BDS-aligned strategy in line with a long-term investment strategy. Given that JLens assessed the historic performance over a ten-year period from 2014 to 2024, JLens aimed to apply a ten-year period to a forecast on the impact of divestment. As JLens had gathered university endowment data from 2023, JLens set a 10-year forecast period from 2023 to 2033.

Step 7: Estimation of Public Equity Allocation

Following the determination of the ten-year forecast period, JLens estimated the portion of university endowments allocated to U.S. large-cap public equities. To determine this share of assets in U.S. public equities, JLens used asset allocation data from NACUBO, who received data from U.S.-based institutions that volunteered to participate in the 2023 NACUBO-Commonfund Study of Endowments (NCSE).[xxiii] According to the study, 12.5% of the dollar-weighted average of all institutions’ endowments were allocated to U.S. active and passive equities, while the other 87.5% endowments were allocated to other assets, such as global equities, emerging market equities, private equity and fixed income. JLens also referred to Cambridge Associates’ measure of the asset allocation of college and university endowments, in which their 2022 study of 127 college and university endowments found that an average of 18% of assets were allocated to U.S. public equities.[xxiv]

JLens estimated that 10% of university endowments were allocated to U.S. large-cap public equities, on average. JLens’ estimate of this 10% allocation was centered on the assumption that the majority of the U.S. active and passive equities were invested in U.S. large-cap public equity funds that were similar to the VettaFi 500 index. However, universities may have larger or smaller U.S. large-cap public equity allocations. To create a standard assessment, JLens applied the 10% asset allocation to all 100 university endowments (see Appendix 2.2).

Step 8: Application of Performance Differences

For each university’s estimated public equity allocations, JLens applied the historic ten-year VettaFi 500 index’s annualized performance of 12.9% and the VettaFi Excl. BDS Top Targets index’s annualized performance of 11.1% to form a projection of the endowment’s public equity market value in 2033 (see Appendix 2.2). As JLens had measured historic performance of the VettaFi 500 index and VettaFi Excl. BDS Top Targets index over a period of ten years, JLens made an assumption that future performance would mirror the historic performance over the same length of time.

Step 9: Calculation of Potential Losses (Foregone Gains)

JLens measured the projected loss to each endowment that applies this BDS-aligned strategy for its U.S. large cap public equity assets. JLens subtracted the 2033 endowment market value of an university endowment invested in the VettaFi Excl. BDS Top Targets index from the 2033 endowment market value of an university endowment invested in the VettaFi 500 index.

Step 10: Aggregation and Analysis of Results

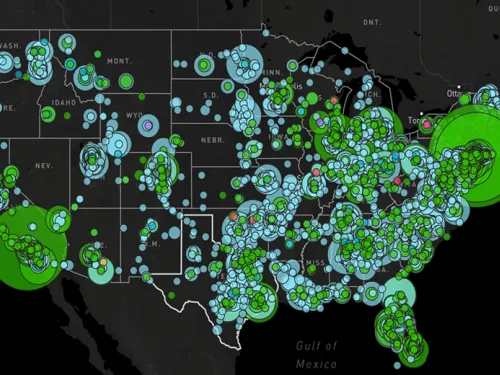

By 2033, JLens found that the 100 largest university endowments would have an aggregate loss of $33.21 billion, if these institutions were to adopt BDS-aligned investment strategies for their public equity asset allocations. The five largest university endowments in 2023 – Harvard University, University of Texas System, Yale University, Stanford University, and Princeton University – would each lose approximately two billion dollars of their future endowment market value on average (see Exhibit Eight and Appendix 2.2).

Exhibit Eight

The projected loss of value for the five largest university endowments from 2023 to 2033:

Research Design Limitations

The research design has several key limitations that are important to consider when interpreting the results. These limitations reflect the complexities of forecasting the potential financial impact of BDS-aligned investment strategies on university endowments:

1) Core assumption that historical performance predicts future results: The assumption that future performance will mirror historical performance is a simplification that may not hold true.

2) Selection of companies in the BDS Top Targets List: The dynamic nature of BDS campaigns means that targets can change over time and this report provides a snapshot based on current information. Different BDS organizations often have varying criteria for targeting companies, leading to potential discrepancies in company lists. The BDS Top Targets List may not be exhaustive of all large-cap public equity companies targeted by the BDS movement. The focus on companies in the VettaFi 500 index limits the analysis to large-cap U.S. companies, potentially missing impacts on international or smaller companies that may also be BDS targets. It's important to note that a larger or smaller group of BDS-targeted companies could significantly change the results of the analysis. In other words, the forecast is impacted by the size and the constituents of the BDS Top Targets List.

3) Time horizon of 10 years: While a ten-year period captures medium-term trends, it may not reflect longer-term economic cycles or geopolitical shifts that could impact performance. The chosen period (2014-2024) includes specific events such as the COVID-19 pandemic and a significant tech sector boom, which may have disproportionately affected certain sectors or companies. A longer or shorter time frame could potentially yield different results, especially given the evolving nature of global markets and geopolitical situations.

4) Methodological constraints: The estimation of university endowments' public equity allocations at 10% is a simplification. Actual allocations may vary significantly among institutions, which could affect the accuracy of the projections. Applying a uniform performance difference across all endowments does not account for variations in investment strategies and specific portfolio compositions among different universities. The analysis is based on the VettaFi 500 index, which, while similar to the S&P 500, may have slight compositional differences that could impact results.

These limitations are inherent to the nature of this exercise. There are infinite hypothetical scenarios one could run, varying the number of companies that are negatively screened and the time horizon. In any such exercise, the analyst needs to make decisions that seem reasonable given the available data and context. While there is obviously no way to predict the future with certainty, the approach that JLens has taken - using historical data to inform potential future outcomes - is a relatively common technique in a forward-looking financial analysis.

Conclusion

The analysis presented in this report demonstrates that adopting an investment strategy aligned with the Boycott, Divestment and Sanctions (BDS) movement could have significant negative financial implications for university endowments.

Key findings include the following:

- Historical Underperformance: The VettaFi Excl. BDS Top Targets index underperformed the VettaFi 500 index over a ten-year period, with an annualized return difference of 1.8% (11.1% vs. 12.9%).

- Substantial Cumulative Impact: Due to the compounding effect, this performance gap translates to substantial performance differences over time. For example, a $1 billion allocation could miss out on nearly $500 million in gains over a decade.

- Projected Aggregate Loss: If the 100 largest university endowments were to adopt BDS-aligned investment strategies for their public equity allocations, they could face an aggregate loss of $33.21 billion by 2033.

These findings underscore the potential consequences of constraining a portfolio through BDS-aligned investment strategies. Reduced endowment returns could impact a university's financial health and long-term sustainability. Lower investment returns could translate to fewer scholarships, reduced funding for research and less investment in campus facilities and programs. This could potentially compromise the university's ability to fulfill its core educational mission, affecting the quality of education and research opportunities available to students and faculty.

While BDS Proponents may point to the research design limitations of this report, JLens is unaware of any comparable research that attempts to quantify the financial implications of BDS-aligned investment strategies in such a comprehensive manner. This study represents a crucial first step in fostering a data-driven conversation about the potential economic consequences of divestment. By initiating this quantitative approach, JLens aims to move the conversation on divestment beyond the important ethical issues to also include a thorough examination of the potential economic impact.

It's important to note that the authors view the BDS movement as a fundamentally misguided and harmful campaign that seeks to delegitimize Israel. However, the purpose of this report was not to debate the movement's underlying principles or its potential to foment antisemitism. Rather, this analysis aimed to objectively quantify the potential financial impact of BDS-aligned investment strategies on university endowments. By providing this data, JLens hopes to equip investment committee members and university trustees with crucial information to inform their decision-making process, particularly given the significant financial implications highlighted in this report.

In conclusion, while the debate around BDS often centers on moral and political arguments, this analysis highlights the substantial financial implications that must also be considered. As universities navigate these complex issues, a comprehensive understanding of the potential economic impacts will be crucial for informed decision-making and responsible stewardship of institutional resources.

Appendix

2. Additional Analysis

2.1 Sector Allocations

The sector allocations in the VettaFi Excl. BDS Top Targets index deviate from the VettaFi 500 index. For example, the BDS Proponents disproportionately target technology companies for divestment. In total, 14 of the 38 companies on the BDS Top Targets List are in the Technology or Media & Communications sectors, according to the Intercontinental Exchange’s Uniform Entity Sector (ICE) classification. These companies comprise 21% of the total market capitalization in the VettaFi 500 index. The VettaFi Excl. BDS Top Targets index has a much lower Technology sector allocation of 24.7% compared to the VettaFi 500 index’s Technology sector allocation of 32.3%.

The VettaFi Excl. BDS Top Targets index’s sector allocations are also lower in the Consumer Discretionary, Energy and Media & Communications sectors.

2.2 Projected Impact of Divestment on University Endowments

JLens’ ten-year forecast of 100 universities’ endowment loss from 2023 to 2033, if universities were to invest their public equity assets in the VettaFi Excl. BDS Top Targets index instead of the VettaFi 500 index:

3. Glossary

The “Boycott, Divestment and Sanctions movement (BDS)” is an international campaign aimed at delegitimizing and pressuring Israel, through the diplomatic, financial, professional, academic and cultural isolation of Israel, Israeli individuals, Israeli institutions and, increasingly, Jews who support Israel’s right to exist.

“BDS Proponents” are a set of six different organizations that are proponents of the BDS movement. The BDS Proponents are: American Friends Service Committee, Boycott-Israel.org, the Palestinian BDS National Committee, the Office of the United Nations High Commissioner for Human Rights (OHCHR), Who Profits and Don’t Buy Into Occupation Coalition. For more information on each of the BDS Proponents, see Appendix 1.

The “BDS Top Targets List” is a negative screen that JLens applied to the VettaFi 500 index to create the VettaFi Excl. BDS Top Targets index. The BDS Top Targets List is a list of 38 companies that have been targeted by at least one BDS Proponent and are in the VettaFi 500 index.

The “VettaFi 500 index” is the VettaFi US Equity Large-Cap 500 Index, which is an index that represents the 500 largest U.S. stocks by market capitalization. VettaFi, a financial services company, manages the VettaFi 500 index.

The “VettaFi Excl. BDS Top Targets index” is the index that is created when the BDS Top Targets List was applied to the VettaFi 500 index as a negative screen. VettaFi removed the 38 companies on the BDS Top Targets List from the VettaFi 500 index to form the VettaFi Excl. BDS Top Targets index.

About JLens

Founded in 2012, JLens empowers investors to align their capital with Jewish values and advocates for Jewish communal priorities in the corporate arena including combating antisemitism and Israel delegitimization. More than 30 Jewish institutions, representing $10 billion in communal capital, have invested more than $260 million in products licensing JLens' Jewish screening, research and advocacy strategy (“Jewish Advocacy Strategy”). These institutions include major Federations, national nonprofits, Jewish Community Foundations, synagogues, day schools and private foundations. In 2022, JLens became a part of the Anti-Defamation League (ADL) family. For more information about our work, please visit www.jlensnetwork.org

Disclaimer: This information is for educational purposes only and should not be interpreted as investment advice or an investment offering. Investors should consult with an advisor to determine the suitability of any investment option or strategy. JLens is not a registered investment advisor, makes no representation as to the advisability of investing in any investment fund or other vehicle. JLens disclaims responsibility or liability for any advice given to third parties or decisions to invest in any investment or other vehicle by you or third parties based on the information. Any investment in funds involves a risk of losing money. Past performance is not indicative of future results.

Endnotes

[i] ADL, “FAQs on the Boycott, Divestment, Sanctions (BDS) Movement on Campus,” May 17, 2024, Accessed August 20, 2024. https://notoleranceforantisemitism.adl.org/resources/blog/faqs-boycott-divestment-sanctions-bds-movement-campus.

[ii] ADL Center on Extremism, “Campus Antisemitism Surges Amid Encampments and Related Protests at Columbia and Other U.S. Colleges,” May 1, 2024, Accessed August 15, 2024. https://www.adl.org/resources/blog/campus-antisemitism-surges-amid-encampments-and-related-protests-columbia-and-other.

[iii] UCLA Alumni, “UCLA Campus Protests,” October 9, 2023, Accessed August 15, 2024. https://alumni.ucla.edu/campus-protests/.

[iv] ADL Center on Extremism, “Anti-Israel Protestors Glorify Terror Groups, Violence,” April 26, 2024, Accessed August 15, 2024, https://www.adl.org/resources/blog/anti-israel-protesters-glorify-terror-groups-violence.

[v] Includes, but is not limited to, HP (HPQ), Intl Business Machines (IBM), Intel (INTC), Microsoft (MSFT), Nvidia (NVDA)

[vi] Includes, but is not limited to, PepsiCo (Pep)

[vii] Includes, but is not limited to, Airbnb (ABNB), Booking (BKNG), Expedia Group (EXPE)

[viii] Includes, but is not limited to, Alphabet (GOOGL), Amazon (AMZN), Boeing (BA), Caterpillar (CAT), Cisco Systems (CSCO), Ford Motor (F), General Dynamics (GD), General Motors (GM), Hewlett Packard Enterprise (HPE), L3Harris Technologies (LHX), Lockheed Martin (LMT), Motorola Solutions (MSI), Northrop Grumman (NOC), RTX Corp (RTX), Textron (TXT), Dell Technologies (DELL), and Palantir Technologies (PLTR)

[ix] Includes, but is not limited to, Citigroup (C), JPMorgan Chase (JPM), and PayPal (PYPL)

[x] Includes, but is not limited to, Chevron (CVX), First Solar (FSLR), and General Electric (GE)

[xi] Includes, but is not limited to, McDonalds (MCD), Walt Disney (DIS), Meta Platforms (META), Starbucks (SBUX), Valero Energy (VLO), and Exxon Mobil (XOM)

[xii] The report will describe what leads to the composition of this list.

[xiii] The results borne of choosing the VettaFi US Equity Large-Cap 500 Index are substantially the same (directionally and magnitude) as if the S&P 500 Index was used for the analysis.

[xiv] Brown Divest, “Divest Campaign,” Accessed August 15, 2024. https://browndivest.org/companies. Yasu Shinozaki and Layla Wallerstein, "Board Turns Down Divestment Proposal," The Oberlin Review, September 6, 2024, Accessed September 9, 2024, https://oberlinreview.org/33111/news/board-turns-down-divestment-proposal/.

[xv] Dastin, Jeffrey, “Microsoft to divest AnyVision stake, end face recognition investing,” Reuters, March 27, 2020, Accessed August 15, 2024, https://www.reuters.com/article/technology/microsoft-to-divest-anyvision-stake-end-face-recognition-investing-idUSKBN21E3BA/.

[xvi] Hudson, John, “How Coca-Cola tried and failed to suppress a boycott over Gaza,” The Washington Post, August 12, 2024, Accessed August 20, 2024, https://www.washingtonpost.com/national-security/2024/08/12/coca-cola-boycott-israel-gaza/.

[xvii] All trademarks, logos and brand names are the property of their respective owners. All company, product and service names used in this website are for identification purposes only. Use of these names, trademarks and brands does not imply endorsement.

[xviii] ADL, “FAQs on the Boycott, Divestment, Sanctions (BDS) Movement on Campus,” May 17, 2024, Accessed August 15, 2024, https://notoleranceforantisemitism.adl.org/resources/blog/faqs-boycott-divestment-sanctions-bds-movement-campus

[xix] The S&P 500 was not used for this analysis because doing so requires a special license from S&P Global. JLens is licensed to use the VettaFi 500.

[xx] The Principles for Responsible Investment (PRI) defines screening as “applying filters to lists of potential investments to rule companies in or out of contention for investment, based on an investor’s preferences, values, or ethics.” Negative screening is the exclusion or avoidance of certain sectors, companies, or securities:

Principles for Responsible Investment, “Introductory Guides to Responsible Investment: Screening,” May 29, 2020, Accessed August 15, 2024, https://www.unpri.org/introductory-guides-to-responsible-investment/an-introduction-to-responsible-investment-screening/5834.article.

[xxi] Portfolios are float-market cap weighted. All portfolios are indexes. Reported returns are USD total returns that include the reinvestment of distributions (e.g., dividends). Results represent a historic simulation of a strategy that was not in effect. Indexes are not investable products and do not include management or trading fees to which an actual investor would be exposed.

[xxii] "Total AUM as of a fiscal year end of June 30, 2023, which is the most recent data reported from universities to the NACUBO-Commonfund Study of Endowments NACUBO, “Public NCSE Tables,” August 12, 2024, Accessed August 15, 2024, https://www.nacubo.org/Research/2024/Public-NCSE-Tables"

[xxiii] NACUBO, “Public NCSE Tables,” August 12, 2024, Accessed August 15, 2024, https://www.nacubo.org/Research/2024/Public-NCSE-Tables

[xxiv] Cambridge Associates, “Endowments Quarterly: A Look at Asset Allocation and Total Returns for US Endowments and Foundations,” March 2023. Accessed August 15, 2024, https://publishedresearch.cambridgeassociates.com/wp-content/uploads/2023/03/2023-03-Endowments-Quarterly-4Q2022.pdf.

[xxv] American Friends Service Committee, “About,” 2024, Accessed August 15, 2024, https://afsc.org/about.

[xxvi] American Friends Service Committee, “What you should know about AFSC’s support for the BDS movement,” January 7, 2019, Accessed August 15, 2024, https://afsc.org/news/what-you-should-know-about-afscs-support-bds-movement.

[xxvii] Investigate is a project of the Economic Activism Program of the AFSC: American Friends Service Committee, “Are There Human Rights Violations Hidden in Your Investments,” Investigate, 2022, Accessed August 15, 2024, https://investigate.afsc.org/.

[xxviii] The Divestment List is composed by the AFSC Action Center for Corporate Accountability: American Friends Service Committee, “Divesting for Palestinian Rights,” Action Center for Corporate Accountability, May 2024, Accessed August 15, 2024. https://afsc.org/divest?ms=web24HG.

[xxix] Boycott-Israel.org, “About Us,” 2024, Accessed August 15, 2024, https://boycott-israel.org/about.html

[xxx] Boycott-Israel.org, “Why Boycott Matters & The Strategy,” 2024, Accessed August 15, 2024. https://boycott-israel.org/boycott-strategy.html.

[xxxi] Boycott-Israel.org, “Alleviating Suffering Through Targeted Action,” 2024, Accessed August 15, 2024. Boycott-Israel.org.

[xxxii] Palestinian BDS National Committee, “What Is BDS,” Accessed August 15, 2024, https://bdsmovement.net/what-is-bds.

[xxxiii] Palestinian BDS National Committee, “BDS Movement,” Accessed August 15, 2024, bdsmovement.net.

[xxxiv] United Nations Office of the High Commissioner for Human Rights, “About UN Human Rights,” 2024, Accessed August 15, 2024, https://www.ohchr.org/en/about-us.

[xxxv] United Nations Human Rights Council, “Database Pursuant to Human Rights Council Resolution 31/36,” 2024, Accessed August 15, 2024, https://www.ohchr.org/en/hr-bodies/hrc/regular-sessions/session31/database-hrc3136.

[xxxvi] United Nations Office of the High Commissioner for Human Rights, “OHCHR update of database,” June 30, 2023, Accessed August 15, 2024, https://www.ohchr.org/sites/default/files/documents/hrbodies/hrcouncil/sessions-regular/session31/database-hrc3136/23-06-30-Update-israeli-settlement-opt-database-hrc3136.pdf.

[xxxvii] Who Profits, “Who Profits Research Center,” Accessed August 15, 2024, https://www.whoprofits.org/sections/view/3?who-profits-research-center.

[xxxviii] Don’t Buy into Occupation, “About Us,” 2024, Accessed August 15, 2024, https://dontbuyintooccupation.org/about-us/.

[xxxix]Don’t Buy into Occupation, “European Financial Institutions’ Continued Complicity in the Illegal Israeli Settlement Enterprise,” December 2023, Accessed August 15, 2024, https://dontbuyintooccupation.org/wp-content/uploads/2023/12/2023_DBIO-III-Report_11-December-2023.pdf#.

[xl] NACUBO, “Public NCSE Tables,” August 12, 2024, Accessed August 15, 2024, https://www.nacubo.org/Research/2024/Public-NCSE-Tables